New analysis of 10 years of state-level data on the way utilities operate in America has found that energy efficiency is the third largest resource in the electric power sector.

The American Council for an Energy-Efficient Economy, which performed the analysis, also found that energy efficiency has averted the need to build the equivalent of 313 power plants since 1990, and avoided 490 million tonnes of carbon dioxide emissions in 2015 alone.

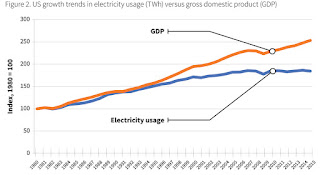

Another surprising result is that electricity consumption in the United States has plateaued in recent years, even as the American economy has grown.

A $90 billion a year saving

As a result customers have saved US$90 billion (AU$118b) a year on bills. This translates to an average of $840 a year (AU$1100) for each American household.Other benefits include economic development, job creation, community and grid resilience, combating fuel poverty, and improved health, safety and comfort.

Energy efficiency could soon be number one resource

Progress has been so successful that ACEEE is daring to predict that energy efficiency could become the US’s number one resource by 2030, if further targeted policies are adopted. And they say any other country can emulate this progress by adopting similar policies.These policies are:

- improved efficiency standards for appliances and equipment

- giving utilities energy efficiency targets of, say, 1.5 per cent a year

- rigorous enforcement of energy-saving codes for buildings, both existing and new

Action at the state level has been crucial for these achievements. According to ACEEE, improving energy efficiency has helped states comply with the Environmental Protection Agency’s Clean Power Plan, which tackles greenhouse gas emissions in the electricity sector. It says most states could meet at least 25 per cent of their targets through efficiency policies and related investments and many could even achieve 100 per cent.

According to the EPA, treating energy efficiency as a resource could benefit other sectors as well, particularly the transportation sector, which in the US is responsible for 26.5 per cent of greenhouse gas emissions. It says the sector could potentially reach zero emissions by 2050, with half of the savings coming from energy efficiency.

Treating energy efficiency as a resource has further benefits: it means that it can be traded in the same way as other energy resources such as oil and gas. This approach is advocated by the vice president of the European Commission in charge of Energy Union, Maroš Šef?ovi?.

We need to adopt the language of energy traders

Energy efficiency expert Dr Steven Fawkes thinks the industry should adopt the language of energy traders to encourage investors and banks to trade in the assets that are represented by potential energy efficiency savings.He says: “Given that nearly every building has reserves of energy efficiency potential we need to think about mechanisms that value that potential, just like we value oil and gas fields before they are exploited.”

Energy trading could be worth €70-100 billion a year

Besides ACEEE, this approach is being pioneered by organisations such as the Energy Efficiency Financial Institutions Group De-risking Project and the Investor Confidence Project. These have put a value on the potential market for energy efficiency resources of around €70-100 billion (AU$104-148 billion) a year in Europe alone. For comparison, in 2015 US$58 billion (AU$76b) was invested into renewables, down sharply from US$132 billion (AU$173b) in 2011.And, like ACEEE, Fawkes points to the many non-energy benefits that come from improved energy efficiency – everything from increased sales and productivity through to health and wellbeing effects – arguing that these “are much more strategic and attractive to decision-makers than ‘mere’ energy savings”.

As a leading European campaigner on this topic, he observes that “many institutional investors and banks are now really interested in energy efficiency – this is a major change over the last three to five years”.

“Efficiency has real economic benefits, it has impact and it is not reliant on subsidies. Because of this the efficiency industry can no longer rely on that old excuse… there is no money. There is plenty of money but a lack of investable deals.”

But there are still many barriers to investment, to actual deals taking place compared to the potential. These are being addressed by the above organisations as follows:

The EEFIG De-risking project, funded by the European Commission, is building a database of project performance using several hundred projects so that owners and investors can see how projects actually perform in order to build an actuarial database of actual performance – both energy and financial performance. It is also developing standardised underwriting procedures such that banks and financial institutions can better assess both the value and the risks of energy efficiency projects that will lead to better pricing and help to build capacity.

The Investor Confidence Project began in US and has been imported to Europe by Fawkes. It is introducing standardisation to the industry with a set of common protocols for developing and documenting projects. It is also introducing a form of project developer and quality assurance called Investor Ready Energy Efficiency. Projects are accredited. This gives confidence to investors and reduces transaction costs.

According to Fawkes, “Our investor network has over €1 billion (AU$1.48b) they would like to deploy into energy efficiency and many of them offer lower fees or interest rates for standardised ICP accredited projects.”

Back to that ACEEE report. It finds further barriers to investment in energy efficiency as follows:

- Imperfect information: Consumers have limited awareness of energy performance of equipment and buildings and limited access to energy usage data.

- Split incentives: Rental properties are a common example. Because tenants pay the energy bills, landlords have little incentive to make efficiency investments to reduce energy bills.

- Regulatory and legal barriers: In many electric utility business models, greater profits are tied to selling more energy and making more capital investments. These objectives are at odds with energy efficiency, whose goal is to reduce energy waste.

- Externalities: The environmental, health and security costs to society of energy production and transmission are not added to energy prices. Although energy efficiency helps reduce these costs, the savings are rarely recognised.

For example, in a recent study, ACEEE analysed 18 measures, including reducing plug loads, conservation voltage reduction and smart manufacturing. It found these could collectively save 22 per cent of total projected electricity use in 2030.

“These savings could effectively bend the curve of energy consumption so we use increasingly less energy while growing our economy,” it says.

It goes further by arguing that “energy efficiency and renewable energy working together can lower a building’s carbon footprint to zero”.

Nevertheless, “critical support is needed from government, industry, and the non-profit community so that scientists, analysts and advocates can continue to save energy everywhere it’s wasted”.

David Thorpe is the author of:

- Best Practices and Case Studies for Industrial Energy Efficiency Improvement (with Oung, K. and Fawkes, S. UNEP, 2016)

- A London Conversation: Business Briefing on Green Bonds (The Fifth Estate, 2015)

- The One Planet Life (Introduction: Jane Davidson. Routledge, 2015)

- Earthscan Expert Guide to Energy Management in Buildings (Earthscan, 2013)

- Earthscan Expert Guide to Energy Management in Industry (Earthscan, 2013)

- Earthscan Expert Guide to Solar Technology (Earthscan, 2011)

- Earthscan Expert Guide to Sustainable Home Refurbishment (Earthscan, 2010)

No comments:

Post a Comment