Green member of the Linz municipal government in Austria Eva Schobesberger says accounting rules on energy efficiency investment need to change.

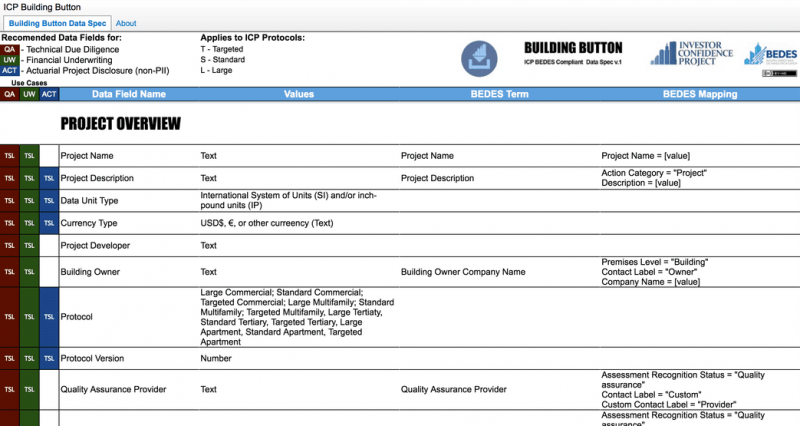

Last month saw the launch of the

Investor Confidence Project Europe, ironically the brainchild of an American NGO, the Environmental Defense Fund. Its purpose is to help connect real estate developers who need private investment with quality-guaranteed energy efficiency projects that deliver both financial and environmental results.

One of the founder members of the group is Deutsche Bank’s

European Energy Efficiency Fund. The launch was welcomed by Lada Strelnikova, director Deutsche asset management and investment manager for the EEEF, who said, “As an alternative, innovative financing instrument for energy efficiency projects in the public sector, we, in Europe, believe standardised energy upgrade approaches can accelerate project progress and facilitate a more structured project development approach to get access to financing.”

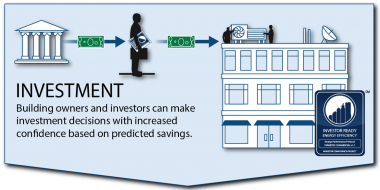

ICP’s Investor Ready Energy Efficiency certified projects are accredited against industry standards and best practices, which is intended to reduce transaction costs and to increase confidence in savings to help engage private capital and scale up energy efficiency investments globally.

“The potential market for building retrofits in Europe is upwards of €100 billion [AU$155.66b] a year, presenting a massive, untapped investment opportunity,” ICP Europe’s director Panama Bartholomy said.

“It offers investors a common language to compare risks and savings makes projects simpler, decisions easier, and project performance more reliable. We invite cities, building owners and local governments to help develop these types of projects and meet our investor network to help finance them.”

Red tape barrier

But there may not be a queue of people rushing to beat on their door, at least from the public sector. One reason amongst many is a clause in European Commission accounting rules defining how the costs of retrofitting public buildings for energy efficiency are accounted for on the balance sheets of governments and local authorities.

These “Eurostat” rules currently classify such investments by default as government expenditure, despite the fact that projects are frequently being financed wholly or in part by the private sector – who also take the risk. The direct consequence is that such investments are counted towards public sector debt.

The rules are being

questioned by Climate Alliance, a group that has over 1700 members from municipalities throughout Europe, and which stands for “a holistic approach to climate protection”.

It is criticising these rules as “a major disincentive to act because the investment appears on the government’s balance sheet”.

“In many European countries, the focus is on reducing public sector debt, so anything which appears to increase it, even though it does not in reality, is not going to happen,” Green member of the Linz municipal government in Austria

Eva Schobesberger said.

Schobesberger is the city’s councillor for women, environment, nature conservation and education, and was top candidate of the Linz Greens for the municipal elections in 2015 and the first Green mayor candidate.

“We need to look again at whether the accounting rules are fit for purpose and deliver progress on the Stability Pact objectives, such as halting unnecessary public spending. Energy efficiency projects in our building stock are just about that,” she said.

The

Eurostat Guidance Note for public authorities on the impact of energy performance contracts on government accounts was issued 7 August 2015 and says:

“As a practical rule, given the high likelihood that capital expenditure incurred in the context of EPCs would have to be recorded in government accounts anyway, Eurostat considers that all capital expenditure within EPCs should be treated, by default, as government expenditure through gross fixed capital information (or as intermediate consumption in the case of simple service procurement, as described above).”

The guidance does allow for the occasional exception:

“Whenever for some individual sizeable contract there would be a presumption that it could satisfy all conditions for being a PPP and at the same time be recorded off-government balance sheet, an analysis might be conducted by the National Statistical Institute of the country involved, in co-operation with Eurostat.”

A spokesman said the rules were under consideration for review, but this could take a very long time.

But how accurate are EPCs anyway?

There is also the question of how useful Energy Performance Certificates are. The latest

statistics for the UK (and it should be noted that for public buildings Display Energy Certificates are used, which show the actual energy consumption of a building and are accompanied by reports which provide recommendations on potential energy saving measures similar to EPCs) show that 258,960 EPCs have been issued since the scheme began in 2008.

Only eight per cent of these buildings have a rating of A or B. Fifty-nine per cent are in the C and D bracket with the remaining in the E,F and G bracket. Seventy per cent of Display Energy Certificates and 66 per cent of Non-Domestic Energy Performance Certificated lodged across London have a rating of D or below. There is clearly much room for improvement.

Research has also shown that EPCs may not accurately reflect the actual energy use of buildings.

For example, research published by the Royal Institution of Charter Surveyors in 2012 suggested that “… in low labelled dwellings the energy use is less than expected, in the high labelled dwellings the energy use is somewhat higher than expected”.

Another

2012 report by Jones Lang LaSalle and the Better Buildings Partnership, based on a study of over 200 buildings, found that “…EPCs alone are not sufficient in delivering the Government’s decarbonisation targets nor are they capable of accurately portraying a building’s true energy efficiency”.

The British Association of Energy Conscious Builders, whose members are passionate about building energy efficiency,

responded to a recent government consultation on EPCs by urging the government “to look not just at EPC ratings but also at the installed performance of efficiency improvements”.

It believes that just as there are warranties for boiler installations, so should there be for “the design, specification and installation of the full range of other energy efficiency interventions”. It cites as an example how the detailing of a solid wall insulation installation can affect the final heat loss through the walls by as much as 30 per cent.

This of course is all the more an argument for ICP’s protocols, which do just that in order to boost confidence in the final results. It is a reason not to rely on EPCs alone. But unless Eurostat rules are changed, the owners of public buildings are going to have to mount some pretty fierce financial arguments to make the case for much-needed energy efficient retrofits. Either that, or avoid reference to EPCs altogether.

David Thorpe is the author of: