I'm thrilled that my important new book, 'One Planet' Cities: Sustaining Humanity within Planetary Limits, will be out next May.

It addresses the crucial question of how the essential needs of the growing human population can be met without breaking the Earth's already-stretched life-support system and is the product of years of research, thinking, and conversations. It builds on the work of Kate Raworth's Doughnut Economics and the Global Footprint Network.

With four out of five people predicted to be urban dwellers by 2080, ‘One Planet’ Cities proposes a pathway to genuine sustainability for cities and neighbourhoods, using an approach based on contraction and convergence.

Utilising interviews with key players, including the Global Footprint Network, World Future Council, WWF, mayors and officials, and case studies from across the globe, including Europe, North and South America, Australia, Sweden, South Africa, China, and India, David Thorpe examines all aspects of modern society from food provision to neighbourhood design, via industry, the circular economy, energy and transport through the critical lens of the ecological footprint and relevant supporting international standards and indicators.

Recommendations on managing supply chains and impacts, how the transition to a world within limits might be financed, and a deep examination of the Welsh Government's pioneering efforts follow. It concludes with an imagined vision of what a genuinely sustainable future might be like, and an appeal for 'one planeteers' everywhere to step up to the challenge.

This book will be of great interest to practitioners and policymakers involved in governance, administration, urban environments and sustainability, alongside students of the built environment, urban planning, environmental policy and energy.

I'm delighted that it has a foreword by Herbert Girardet, founder of the World Futures Council.

From January 2019 I'll be publishing biweekly extracts to generate momentum for the launch. Watch this space!

You can pre-order the title here: https://www.routledge.com/One-Planet-Cities-Sustaining-Humanity-within-Planetary-Limits/Thorpe/p/book/9781138615106

Friday, December 21, 2018

Monday, July 23, 2018

The energy and housing transitions are being led by communities

Across three continents, citizens are working with their local communities to build more sustainable futures for themselves in housing and energy.

In Solapur, India, housing cooperatives have come together to build more than 15,000 affordable homes since 2001, relocating thousands of workers from slums.

The Solapur Housing Initiative, led by the Centre of Indian Trade Unions, began construction of another 30,000 homes in January 2018, and recently took out the housing category of the Transformative City award.

Many of these homes – typically around 50 square metres in size – are for beedi workers, poorly paid cigarette-rolling women who are often the sole breadwinners for their families. These women previously rented tiny shanties in slums.

The land purchase cost was shared equally by the worker, the central government and the state government, but the workers struggled for a long time to win their demand and have previous debts cancelled.

The award proves that the sheer strength of workers’ sustained efforts, with the cooperation of governments, can deliver results.

On the other side of the world, in Bolivia, the residents of San Pedro Magisterio village used to have to fetch water from springs near their polluted river daily.

Then the San Pedro Magisterio grassroots community organisation founded a water cooperative. They drilled wells and built the basic infrastructure to bring water to their homes. The funding to solve all these problems came from contributions made by community members, who did all the work themselves.

They followed this with a long campaign to build a wastewater treatment plant to clean up the highly polluted river. The community set up a reed bed ecological sewage treatment system serving 4000 people.

Resident Doña Magui says they are now trying to replace the reeds with arum lilies because they perform the same function and will help keep the treatment plant going in the long-term, because residents will sell the lilies and put the profits back into maintenance.

“As far as the state is concerned, we don’t exist,” Magui says, adding that it was the residents themselves who built the first school, the church and the first roads. This community was awarded the water category of the Transformative City award.

The third and final energy category was given to the Spanish city of Cadiz for its action plan against energy poverty.

The campaign featured active cooperation between local government leaders and ordinary citizens. A group of unemployed citizens were trained as energy advisers and given an eight-month contract by the city council to tackle unemployment, energy poverty and climate change simultaneously.

The team gives families in Cádiz advice on how to optimise their energy contracts so they pay as little as possible. In just three months, the team ran 60 workshops, gave 640 people training on energy issues, and advised 70 families in their homes, reducing their electricity bills by 20-50 per cent.

There have been 224 households that have changed their contracts to a time-of-day tariff, another sign of the knowledge gained by workshop participants.

EU energy regulation still lacks a commonly agreed legal definition of energy poverty and this prevents the setting of mandatory targets and roadmaps.

Some national governments give low income households the chance to access social tariffs:

The control over revenues from renewable energy projects means that citizens, farmers and local entrepreneurs can directly benefit the local community.

Zomer says that strong collaboration between the market and the community will accelerate the energy transition. "The transition to a carbon free electricity system needs to be a democratic transition, giving all citizens the opportunity to participate. As part of the overall agreement, five hundred districts off the gas pipeline will have a transition plan within three years, agreed between housing collectives and community groups, local municipalities and other parties."

In Mouscron, Belgium (58,000 inhabitants), the first community energy cooperative COOPEM was launched this year by the municipality itself, following a feasibility study and several public meetings, strong involvement of citizens and a partnership with two companies, Energiris (a Brussels citizens’ cooperative) and Aralia (a third-party investor in PV projects).

COOPEM’s equity is owned 55 per cent by citizens, 15 per cent by the municipality and 30 per cent by the two private partners.

Thanks to bulk purchasing and the government’s Qualiwatt subsidy (a feed-in tariff that runs out at the end of July) citizens benefit from a reduction on the cost of the installation. When residents use energy from the grid, their meter runs normally but when their PV panels generate electricity, the meter runs backwards.

Many such organisations are members of the European Federation of Renewable Energy Cooperatives (REScoops), a network of 1,250 European energy cooperatives and their 1.000.000 citizens who are active in the energy transition.

Luzy in France is part of another network, the Village in Transition movement. It boasts a farmers’ corner, associative café, the Horizon, the donation shed, all run by citizens, with municipality support.

Luzy is a member of POTEs (Ordinary Energy Transition Pioneers), fostered by pan-European initiative Energy Cities, whose Carine Dartiguepeyrou says "are every-day-life innovators and visionaries working in areas related to the energy transition that Energy Cities, the Bourgogne Franche-Comté Region and ADEME, the French national energy conservation and environment agency, are forming into a network.

"POTEs are efficient and innovative… they collaborate and take care of others by helping them make progress in their project and overcome difficulties."

She explains that "A good example of this is the 'hold-up' method, a collective intelligence tool used for the third place the Horizon and the farmers’ corner at Luzy. Starting with an issue faced by each project, the participants put forward solutions to help the Horizon find a new business model and the farmers’ corner perpetuate its activity.

"In order to solve concrete challenges faced by project leaders (social entrepreneurs, researchers, engineers, government, NGOs ...), the actors who participate in a Hold-Up discuss and exchange ideas."

Energy communities

The European Council and the European Committee of the Regions (CoR) are drafting models of local energy ownership and the role of local energy communities in energy transition in Europe.

Energy Cities has prepared a joint contribution together with ResCoop.EU, the European federation for renewable energy cooperatives for the European Parliament to move forward on this issue. They are arguing that "only by distributing control among local actors will we be able to get to a fair energy transition and effectively fight climate change. Furthermore, this would contribute to local development and the reduction of (energy) poverty."

They perceive an enormous interest among local authorities to take control of the energy infrastructure, but also a lot of uncertainty on the 'hows and whats', and fear of failure.

Energy communities represent a distinct market actor in the energy system. They can play many roles at the local level such as provision of clean renewable energy and technical expertise. They can also as a partner to support local economic and social objectives.

For REScoop.eu, renewable energy cooperatives are ideal partners to lead the energy transition to energy democracy.

Sharing best practices and organising exchanges between cities can fill in the current knowledge and confidence gap.

So the EU Energy Poverty Observatory has published a new Guidance on designing effective energy poverty policies in municipalities about how to implement realistic and appropriate local energy poverty policies.

The EU Energy Poverty Observatory is now inviting municipalities to apply for technical assistance with the implementation of this guidance, including insights from best practices and recommendations based on the local circumstances.

Power to the people!

David Thorpe’s two new books are Passive Solar Architecture Pocket Reference and Solar Energy Pocket Reference. He’s also the author of Energy Management in Building and Sustainable Home Refurbishment.

|

| New housing in Solapur, India. |

In Solapur, India, housing cooperatives have come together to build more than 15,000 affordable homes since 2001, relocating thousands of workers from slums.

The Solapur Housing Initiative, led by the Centre of Indian Trade Unions, began construction of another 30,000 homes in January 2018, and recently took out the housing category of the Transformative City award.

Many of these homes – typically around 50 square metres in size – are for beedi workers, poorly paid cigarette-rolling women who are often the sole breadwinners for their families. These women previously rented tiny shanties in slums.

The land purchase cost was shared equally by the worker, the central government and the state government, but the workers struggled for a long time to win their demand and have previous debts cancelled.

The award proves that the sheer strength of workers’ sustained efforts, with the cooperation of governments, can deliver results.

On the other side of the world, in Bolivia, the residents of San Pedro Magisterio village used to have to fetch water from springs near their polluted river daily.

Then the San Pedro Magisterio grassroots community organisation founded a water cooperative. They drilled wells and built the basic infrastructure to bring water to their homes. The funding to solve all these problems came from contributions made by community members, who did all the work themselves.

They followed this with a long campaign to build a wastewater treatment plant to clean up the highly polluted river. The community set up a reed bed ecological sewage treatment system serving 4000 people.

Resident Doña Magui says they are now trying to replace the reeds with arum lilies because they perform the same function and will help keep the treatment plant going in the long-term, because residents will sell the lilies and put the profits back into maintenance.

“As far as the state is concerned, we don’t exist,” Magui says, adding that it was the residents themselves who built the first school, the church and the first roads. This community was awarded the water category of the Transformative City award.

The third and final energy category was given to the Spanish city of Cadiz for its action plan against energy poverty.

The campaign featured active cooperation between local government leaders and ordinary citizens. A group of unemployed citizens were trained as energy advisers and given an eight-month contract by the city council to tackle unemployment, energy poverty and climate change simultaneously.

The team gives families in Cádiz advice on how to optimise their energy contracts so they pay as little as possible. In just three months, the team ran 60 workshops, gave 640 people training on energy issues, and advised 70 families in their homes, reducing their electricity bills by 20-50 per cent.

There have been 224 households that have changed their contracts to a time-of-day tariff, another sign of the knowledge gained by workshop participants.

The energy transition and energy poverty

While in the South, communities face more severe problems in transforming themselves to achieve sustainability, in the North it is energy poverty which is frequently the hidden but powerful motivator for change. Energy poverty is where building design and energy supply meet.EU energy regulation still lacks a commonly agreed legal definition of energy poverty and this prevents the setting of mandatory targets and roadmaps.

Some national governments give low income households the chance to access social tariffs:

- In Flanders, Belgium, for example, each household can obtain an annual discount on bills based on its size.

- In Italy, low-income households and large families are offered discounts on gas and electricity bills, – a national plan supported by all municipalities.

- In France social tariffs have been replaced by 'energy cheques', which people can use not only to pay their utility bills but also to finance energy-saving works in their homes.

- In Germany, Berlin’s electricity grid is up for sale approximately every 15 years. When selecting the supplier in 2016, the citizens pushed for fuel poverty to be one of the criteria of buyer selection to be factored in by the local government.

- In England, Plymouth City Council identified community energy as a potential solution to energy poverty and facilitated the creation of Plymouth Energy Community in 2013, which now includes 1200 individuals and organisations who are transitioning to an affordable and low carbon energy system by offering access to grants to cancel energy debt, free and assisted insulation and advice on the best tariff options.

- And a Low Carbon Hub Community Energy Fund is tackling the looming end of the British Feed-in Tariff subsidy for locally-generated solar electricity in March 2019, by fundraising frantically to install as many solar panels as possible on schools and businesses before the deadline. It has already successfully installed a new array at a primary school and is working with Oxfordshire County Council to encourage more schools to follow their example. It is campaigning to raise £1 million by 31st of July 2018, to bring in long term equity from positive investors.

- In Scotland, non-profit social company OurPower, which is owned by social housing providers, community organisations and local authorities, produces and sells its own energy. Profits are reinvested to benefit customers and their community and every member can access locally produced renewable energy at a fair price and is able to control their energy supply and distribution.

- In Wales, a similar approach is achieved by Awel Aman Tawe, which owns a wind farm and has installed photovoltaic rooves on community buildings.

- In the Netherlands, a new Climate Agreement was reached at the beginning of this month which includes a community energy target that requires all new wind and solar projects to be at least half owned by the local community. All 33 Dutch regions have regional energy strategies under development.

The control over revenues from renewable energy projects means that citizens, farmers and local entrepreneurs can directly benefit the local community.

Zomer says that strong collaboration between the market and the community will accelerate the energy transition. "The transition to a carbon free electricity system needs to be a democratic transition, giving all citizens the opportunity to participate. As part of the overall agreement, five hundred districts off the gas pipeline will have a transition plan within three years, agreed between housing collectives and community groups, local municipalities and other parties."

In Mouscron, Belgium (58,000 inhabitants), the first community energy cooperative COOPEM was launched this year by the municipality itself, following a feasibility study and several public meetings, strong involvement of citizens and a partnership with two companies, Energiris (a Brussels citizens’ cooperative) and Aralia (a third-party investor in PV projects).

COOPEM’s equity is owned 55 per cent by citizens, 15 per cent by the municipality and 30 per cent by the two private partners.

Thanks to bulk purchasing and the government’s Qualiwatt subsidy (a feed-in tariff that runs out at the end of July) citizens benefit from a reduction on the cost of the installation. When residents use energy from the grid, their meter runs normally but when their PV panels generate electricity, the meter runs backwards.

Many such organisations are members of the European Federation of Renewable Energy Cooperatives (REScoops), a network of 1,250 European energy cooperatives and their 1.000.000 citizens who are active in the energy transition.

Villages in Transition

Luzy is a member of POTEs (Ordinary Energy Transition Pioneers), fostered by pan-European initiative Energy Cities, whose Carine Dartiguepeyrou says "are every-day-life innovators and visionaries working in areas related to the energy transition that Energy Cities, the Bourgogne Franche-Comté Region and ADEME, the French national energy conservation and environment agency, are forming into a network.

"POTEs are efficient and innovative… they collaborate and take care of others by helping them make progress in their project and overcome difficulties."

She explains that "A good example of this is the 'hold-up' method, a collective intelligence tool used for the third place the Horizon and the farmers’ corner at Luzy. Starting with an issue faced by each project, the participants put forward solutions to help the Horizon find a new business model and the farmers’ corner perpetuate its activity.

"In order to solve concrete challenges faced by project leaders (social entrepreneurs, researchers, engineers, government, NGOs ...), the actors who participate in a Hold-Up discuss and exchange ideas."

Energy communities

The European Council and the European Committee of the Regions (CoR) are drafting models of local energy ownership and the role of local energy communities in energy transition in Europe.

Energy Cities has prepared a joint contribution together with ResCoop.EU, the European federation for renewable energy cooperatives for the European Parliament to move forward on this issue. They are arguing that "only by distributing control among local actors will we be able to get to a fair energy transition and effectively fight climate change. Furthermore, this would contribute to local development and the reduction of (energy) poverty."

They perceive an enormous interest among local authorities to take control of the energy infrastructure, but also a lot of uncertainty on the 'hows and whats', and fear of failure.

Energy communities represent a distinct market actor in the energy system. They can play many roles at the local level such as provision of clean renewable energy and technical expertise. They can also as a partner to support local economic and social objectives.

For REScoop.eu, renewable energy cooperatives are ideal partners to lead the energy transition to energy democracy.

Sharing best practices and organising exchanges between cities can fill in the current knowledge and confidence gap.

So the EU Energy Poverty Observatory has published a new Guidance on designing effective energy poverty policies in municipalities about how to implement realistic and appropriate local energy poverty policies.

The EU Energy Poverty Observatory is now inviting municipalities to apply for technical assistance with the implementation of this guidance, including insights from best practices and recommendations based on the local circumstances.

Power to the people!

David Thorpe’s two new books are Passive Solar Architecture Pocket Reference and Solar Energy Pocket Reference. He’s also the author of Energy Management in Building and Sustainable Home Refurbishment.

Labels:

Co-operatives,

community energy,

energy poverty,

renewable energy,

sustainable community,

water quality

Monday, April 30, 2018

UK and EC drag themselves towards net zero emissions

In both London and Europe, the effort to reduce emissions summons up a picture of a person, put on a diet by a

doctor, eying a cream pie: the head knows it shouldn't eat it, but the

body has to be dragged kicking and screaming away from the table.

That's the picture I get after studying three recent developments – in the UK's climate change legal framework, the EU's Energy Performance of Buildings Directive, and its Climate Action Regulation.

All three developments embody the praiseworthy aspiration to reach net-zero greenhouse gas emissions around the middle of the century (in line with the Paris Agreement on climate change), but the fine words are not yet backed up by measures that will achieve that goal.

The UK's Energy and Clean Growth Minister Claire Perry made a significant and unexpected announcement that she will ask the country's Committee on Climate Change (CCC) for ideas on how to adopt the goal of the Paris Climate Agreement to limit global warming to below 2oC above pre-industrial levels, with an aspiration to keep it below 1.5oC. This means achieving net zero emissions by 2050.

She made the announcement at a meeting of the Commonwealth Heads of Government last week. "After the IPCC report later this year, we will be seeking the advice of the UK’s independent advisers, the Committee on Climate Change, on the implications of the Paris Agreement for the UK’s long-term emissions reduction targets," she said.

The independent Committee on Climate Change (CCC) exists to set five year plans for the UK to meet its legally binding target under the Climate Change Act (2008) of reducing carbon emissions by 80% by 2050 compared to 1990. It then monitors and reports on the UK's progress.

Perry's announcement was welcomed by the low carbon industry and campaign groups, but they cautioned that legislation is needed soon.

Dustin Benton, policy director at thinktank Green Alliance said, "The Government has made real progress on some issues, such as diesel cars and offshore wind, but there are glaring holes in areas such as energy efficiency and onshore renewables," adding waste, housing and transport to the list.

Greenpeace executive director John Sauven said this would mean the end of plans for a new runway at Heathrow. "No new runway at Heathrow will fit inside our carbon budget. The data show that the challenges posed by emissions from transport – land, sea and air – and our reliance on gas for heating will have to be confronted as a matter of urgency."

The CCC itself recently challenged the Government’s policies, saying that they do not go far enough even to meet current targets.

They want to see "urgent action" on the Clean Growth Strategy (published in October 2017), and to see detail on a long list of ideas that have been adopted by the government to reduce emissions but which are not accompanied by substance on strategy.

These include: phasing out sales of petrol and diesel cars and vans by 2040, increasing the energy efficiency of homes by 2035 and the energy efficiency standards of new buildings, how to phase out installation of gas and oil, to generate 85% of the UK’s electricity from low-carbon sources by 2032, and deploying carbon capture and storage technology.

They highlight also a need for new policies to close the remaining ‘emissions gap’ in the fourth and fifth carbon budgets. Even if delivered in full, existing and new policies, including those set out in the Clean Growth Strategy, miss the fourth and fifth carbon budgets by around 10-65 MtCO2e – a significant margin.

The CCC says, "There is a particular risk around meeting the fourth carbon budget which begins in just five years’ time, including completion of Hinkley Point C nuclear power station". This is looking increasingly unlikely due partly to EDF's problems on completing a similar reactor at Flamanville.

The revisions to the previous version of the Directive form the first of eight proposed steps towards the EU’s Energy Union ambitions and include advocating the use of smart technologies to introduce automation and control systems which could ensure buildings operate efficiently, the use of a 'smart readiness indicator' which can measure a building’s capacity to integrate new technologies, support for the introduction of new infrastructure for e-mobility in new buildings, and a path towards zero-emissions buildings by 2050.

There are also mechanisms to create the investment needed to renovate existing buildings to make them more energy efficient: at least 40% of infrastructure and innovation projects financed by the European Fund for Strategic Investments should contribute to the Commission's commitments on climate action and energy transition in line with the Paris Agreement. There is also funding under the European Investment Bank's Smart Finance for Smart Buildings Initiative. This aims to unlock a total of €10 billion in public and private funds between now and 2020 for energy efficiency projects.

The European Commission Vice-President for the Energy Union, Maroš Šefčovič, said: "As technology has blurred the distinction between sectors, we are also establishing a link between buildings and e-mobility infrastructure, and helping stabilize the electricity grid.”

The Council of Ministers have yet to finalise agreement of the Directive before it enters into force. Member States will have to transpose the new elements of the Directive into their national laws within 20 months. If the UK eventually Brexits, it will not have to.

I have already reported here and here on how the Directive has been watered down compared to what it might have been.

How effective it is as will depend on the policies adopted by each Member State, who, in the coming months, are supposed to develop National Energy and Climate Plans to show how they expect to meet their commitments under the directive.

The European Council already has an overall GHG reduction target for the EU, of reducing emissions 40% by 2030 compared to 1990, with a subtarget for sectors not included in the emissions trading system (ETS) of 30% reduction compared to 2005. The CAR gives each country an individual target to implement that target. France and Germany have by far the highest targets. Eastern European and other less industrialised countries such as Greece and Portugal will be able to continue to increase emissions [for the full list see the table on page 5 of this analysis.

This is not as straightforward as it might seem. The CAR is meant to contain flexibilities to let nations meet targets more cost-effectively, but, according to separate analysis by three think tanks (Sandbag, T&E and Öko Institut), this means it is full of loopholes that allow countries to get out of their commitments, meaning it will only lead to 25-26% reductions compared to 2005. Furthermore, they say, it does not provide the incentives to put the EU in line to fully decarbonise these sectors by 2050.

In respect of action on reducing emissions, the UK was one of the EU's high performers. With it out of the Union, the rest will have to try harder to achieve that 40% target. However, T&E says they won't make it. "Countries that will not meet their 2020 targets will be rewarded by being allowed to emit even more".

It cites the example of Ireland, whose emissions since 2011 have steadily increased. Rather than the CAR giving it a baseline starting point for emission reductions of the 2020 target of 20% relative to 2005 levels, it is being given a 2018 level, which means, because it is failing to reduce emissions to badly, it has to achieve just 5% relative to 2005 emissions. Austria, Belgium or Finland could also be among the countries that will benefit from this starting point.

To return to the picture described in my opening paragraph, at least the head has drawn up rules; whether it can implement and enforce them effectively is another matter entirely.

David Thorpe's two new books are Passive Solar Architecture Pocket Reference and Solar Energy Pocket Reference. He's also the author of Energy Management in Buildings and Sustainable Home Refurbishment.

A version of this piece appeared on The Fifth Estate six days ago.

That's the picture I get after studying three recent developments – in the UK's climate change legal framework, the EU's Energy Performance of Buildings Directive, and its Climate Action Regulation.

All three developments embody the praiseworthy aspiration to reach net-zero greenhouse gas emissions around the middle of the century (in line with the Paris Agreement on climate change), but the fine words are not yet backed up by measures that will achieve that goal.

UK sets aim for 'net zero'

|

| Claire Perry |

She made the announcement at a meeting of the Commonwealth Heads of Government last week. "After the IPCC report later this year, we will be seeking the advice of the UK’s independent advisers, the Committee on Climate Change, on the implications of the Paris Agreement for the UK’s long-term emissions reduction targets," she said.

The independent Committee on Climate Change (CCC) exists to set five year plans for the UK to meet its legally binding target under the Climate Change Act (2008) of reducing carbon emissions by 80% by 2050 compared to 1990. It then monitors and reports on the UK's progress.

Perry's announcement was welcomed by the low carbon industry and campaign groups, but they cautioned that legislation is needed soon.

Dustin Benton, policy director at thinktank Green Alliance said, "The Government has made real progress on some issues, such as diesel cars and offshore wind, but there are glaring holes in areas such as energy efficiency and onshore renewables," adding waste, housing and transport to the list.

Greenpeace executive director John Sauven said this would mean the end of plans for a new runway at Heathrow. "No new runway at Heathrow will fit inside our carbon budget. The data show that the challenges posed by emissions from transport – land, sea and air – and our reliance on gas for heating will have to be confronted as a matter of urgency."

The CCC itself recently challenged the Government’s policies, saying that they do not go far enough even to meet current targets.

They want to see "urgent action" on the Clean Growth Strategy (published in October 2017), and to see detail on a long list of ideas that have been adopted by the government to reduce emissions but which are not accompanied by substance on strategy.

These include: phasing out sales of petrol and diesel cars and vans by 2040, increasing the energy efficiency of homes by 2035 and the energy efficiency standards of new buildings, how to phase out installation of gas and oil, to generate 85% of the UK’s electricity from low-carbon sources by 2032, and deploying carbon capture and storage technology.

They highlight also a need for new policies to close the remaining ‘emissions gap’ in the fourth and fifth carbon budgets. Even if delivered in full, existing and new policies, including those set out in the Clean Growth Strategy, miss the fourth and fifth carbon budgets by around 10-65 MtCO2e – a significant margin.

The CCC says, "There is a particular risk around meeting the fourth carbon budget which begins in just five years’ time, including completion of Hinkley Point C nuclear power station". This is looking increasingly unlikely due partly to EDF's problems on completing a similar reactor at Flamanville.

Energy Performance of Buildings Directive

Meanwhile, on 17 April, the European Parliament approved the Energy Performance of Buildings Directive. This will target the renovation of buildings, and the creation of smarter energy systems for new buildings, acknowledging that around 75% of buildings in Europe are currently energy inefficient and that buildings are the largest single energy consumer in Europe, using around 40% of final energy.The revisions to the previous version of the Directive form the first of eight proposed steps towards the EU’s Energy Union ambitions and include advocating the use of smart technologies to introduce automation and control systems which could ensure buildings operate efficiently, the use of a 'smart readiness indicator' which can measure a building’s capacity to integrate new technologies, support for the introduction of new infrastructure for e-mobility in new buildings, and a path towards zero-emissions buildings by 2050.

There are also mechanisms to create the investment needed to renovate existing buildings to make them more energy efficient: at least 40% of infrastructure and innovation projects financed by the European Fund for Strategic Investments should contribute to the Commission's commitments on climate action and energy transition in line with the Paris Agreement. There is also funding under the European Investment Bank's Smart Finance for Smart Buildings Initiative. This aims to unlock a total of €10 billion in public and private funds between now and 2020 for energy efficiency projects.

The European Commission Vice-President for the Energy Union, Maroš Šefčovič, said: "As technology has blurred the distinction between sectors, we are also establishing a link between buildings and e-mobility infrastructure, and helping stabilize the electricity grid.”

The Council of Ministers have yet to finalise agreement of the Directive before it enters into force. Member States will have to transpose the new elements of the Directive into their national laws within 20 months. If the UK eventually Brexits, it will not have to.

I have already reported here and here on how the Directive has been watered down compared to what it might have been.

New EU Climate Action Regulation

A new European Climate Law is also edging closer. The Climate Action Regulation (formerly known as Effort Sharing Regulation) covers almost 60% of all greenhouse gases and establishes annual carbon budgets between 2021 and 2030 for each EU country, covering sectors like surface transport, buildings, agriculture, small industry and waste, as follows:How effective it is as will depend on the policies adopted by each Member State, who, in the coming months, are supposed to develop National Energy and Climate Plans to show how they expect to meet their commitments under the directive.

The European Council already has an overall GHG reduction target for the EU, of reducing emissions 40% by 2030 compared to 1990, with a subtarget for sectors not included in the emissions trading system (ETS) of 30% reduction compared to 2005. The CAR gives each country an individual target to implement that target. France and Germany have by far the highest targets. Eastern European and other less industrialised countries such as Greece and Portugal will be able to continue to increase emissions [for the full list see the table on page 5 of this analysis.

This is not as straightforward as it might seem. The CAR is meant to contain flexibilities to let nations meet targets more cost-effectively, but, according to separate analysis by three think tanks (Sandbag, T&E and Öko Institut), this means it is full of loopholes that allow countries to get out of their commitments, meaning it will only lead to 25-26% reductions compared to 2005. Furthermore, they say, it does not provide the incentives to put the EU in line to fully decarbonise these sectors by 2050.

In respect of action on reducing emissions, the UK was one of the EU's high performers. With it out of the Union, the rest will have to try harder to achieve that 40% target. However, T&E says they won't make it. "Countries that will not meet their 2020 targets will be rewarded by being allowed to emit even more".

It cites the example of Ireland, whose emissions since 2011 have steadily increased. Rather than the CAR giving it a baseline starting point for emission reductions of the 2020 target of 20% relative to 2005 levels, it is being given a 2018 level, which means, because it is failing to reduce emissions to badly, it has to achieve just 5% relative to 2005 emissions. Austria, Belgium or Finland could also be among the countries that will benefit from this starting point.

To return to the picture described in my opening paragraph, at least the head has drawn up rules; whether it can implement and enforce them effectively is another matter entirely.

David Thorpe's two new books are Passive Solar Architecture Pocket Reference and Solar Energy Pocket Reference. He's also the author of Energy Management in Buildings and Sustainable Home Refurbishment.

Monday, April 23, 2018

Has the world reached peak ecological footprint?

[A version of this piece appeared on The Fifth Estate website last week.

For more information on this topic, see: theoneplanetlife.com]

For more information on this topic, see: theoneplanetlife.com]

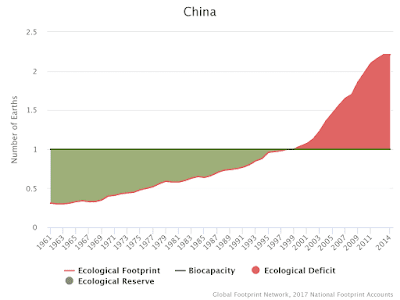

Mathis Wackernagel, founder and CEO of Global Footprint Network, speaking in an interview with me from Oxford University just before the launch, said, "We may have reached peak eco-footprint, after years of expansion. For example, China underwent a rapid expansion of its footprint, and now it has flattened. This could be a real trend."

|

| Peak consumption? In 1961 China was consuming the equivalent of 0.31 Earths of biocapacity, but since then rocketed to 2.21 Earths, where it has sat for the last two years of data. |

What is ecological footprint?

Ecological footprint is a shorthand way of understanding the relationship between our consumption of resources and the capacity of the planet to provide them and absorb the pollution we cause.Every individual, a community or nation has their own ecological footprint. It is the biologically productive space needed to renew all that we demand from nature. For the world as a whole, it was in the early 1970s when humanity started consuming more than the planet could regenerate. From then on we have been in deficit, implying that we cannot carry on consuming at this level without ever-stronger risk of ecological crises.

Global Footprint Network has been providing this country and planetary level data for many years but last week’s launch also saw the launch of a new data platform and an open source system, meaning that anyone can now freely explore and interrogate the data on global or national bases.

The new data is compiled from statistics provided by the United Nations and, being complicated to collect, is always three or four years behind the current year. The first year in which the data was collected was 1961. The new website currently provides time series of data for every year between 1961 and 2014.

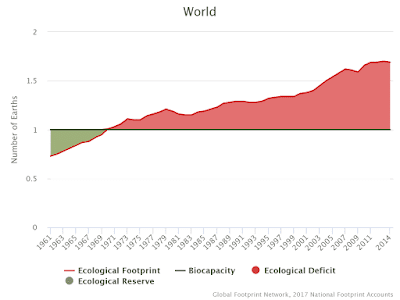

This is what the world’s ecological footprint looks like over this period:

|

| From 1961 to 2014 we have gone from exploiting 0.63 Earth-equivalents to 1.69, approximately flatlining for four years. |

“We don’t know whether or not this is a blip or a trend. It is too early to say,” Wackernagel said.

|

| Mathis Wackernagel |

Individual country data compares consumption data to biocapacity data. What Wackernagel is referring to here is that India, despite having a total per capita footprint of 0.67 Earth-equivalents, is in deficit in relation to what it is able to supply itself to feed its consumption, and is therefore using biocapacity from other countries to fuel its rapid pace of development.

The data is compiled from UN information on population and the amount of built-up land, carbon emissions, cropland, fishing grounds, forest products and grazing land.

For the world as a whole, the peak was in 2011. It is interesting to compare the statistics for 1961, 2011 and 2014 to see what has changed to cause this overall peaking:

| Year | Built-up land | Carbon emissions | Cropland | Fishing grounds | Forest products | Grazing land | Total |

| 1961 | 0.026 | 1.005 | 0.465 | 0.096 | 0.431 | 0.265 | 2.288 |

| 2011 | 0.061 | 1.779 | 0.533 | 0.087 | 0.281 | 0.147 | 2.888 |

| 2014 | 0.064 | 1.707 | 0.550 | 0.093 | 0.278 | 0.144 | 2.835 |

The amount of built-up land has steadily increased over the entire period, but carbon emissions have recently slightly decreased. While the amount of fishing grounds, forest products and grazing land have all continued to decline, the amount of cultivated land is almost back to the level of 1961.

Biocapacity is also shrinking quite rapidly per person, so even though per person ecological footprint has not changed that much, its ratio to biocapacity has become ever more unfavourable.

This implies pressures on biodiversity. It does not tell us about the nitrogen and phosphorus pollution caused by this increase in agriculture. For this we have to look for other statistics not covered by the ecological footprint metric, but covered by a different metric – planetary boundaries, collated annually by the Stockholm Resilience Centre.

As can be seen in the above diagram this is one of the four boundaries that have been exceeded.

Australia and the UK

The website allows anyone to play with the data. Let’s compare, for example, the ecological footprints of Australia and the UK.Australia is using the resources of 4.09 Earths, down from a peak of 5.15 Earths in 2011.

The UK is using the resources of 2.85 Earths, down from a peak of 3.55 Earths in 2011.

In addition, both of these countries’ ecological footprints of consumption (in global hectares divided by population) have declined slightly since their peaks, in 2008 and 2007 respectively:

|

Australia's ecological footprint in terms of the number of Earths needed to sustain it, if everyone on the planet had the same level and impact of consumption as Australia does. |

|

| The UK's ecological footprint, pictured the same way. The UK's has reduced since the financial crisis of 2007. |

In the UK’s case, if we drill down to the category level, the reason for the fall is solely a reduction in carbon emissions (which is largely due to a switch for gas to coal-powered electricity generation, but also due to a cut in fishing grounds due to previous over-fishing). The area of built-up land has just over doubled since 1961:

UK time series:

| Year | Built-up land | Carbon emissions | Cropland | Fishing grounds | Forest products | Grazing land | Total |

| 1961 | 0.068 | 3.835 | 0.803 | 0.396 | 0.297 | 0.751 | 6.150 |

| 2007 | 0.139 | 4.240 | 0.815 | 0.103 | 0.623 | 0.324 | 6.245 |

| 2014 | 0.156 | 2.996 | 0.832 | 0.082 | 0.483 | 0.250 | 4.799 |

|

| UK's ecological footprints in 1961, 2007 and 2014. |

In Australia’s case, again there was a decline in carbon emissions. The area of built-up land has almost tripled since 1961:

Australia time series:

| Year | Built-up land | Carbon emissions | Cropland | Fishing grounds | Forest products | Grazing land | Total |

| 1961 | 0.024 | 3.026 | 0.527 | 0.049 | 1.031 | 2.813 | 7.471 |

| 2008 | 0.047 | 5.867 | 0.872 | 0.127 | 1.206 | 0.872 | 8.992 |

| 2014 | 0.063 | 4.700 | 0.679 | 0.122 | 0.863 | 0.458 | 6.886 |

|

| Australia's ecological footprints in 1961, 2007 and 2014. |

Other trends are not improving, however.

What can be done?

Despite the levelling out, Wackernagel remains alarmed by humanity’s unsustainable activities.“People don’t look at this stuff. Instead, they’re buoyant about labour productivity, but this came about because of cheap energy and resources. Now we need to maintain our quality of life but reduce resource use.”

But he sees a way out.

“Total and ever-lasting decoupling of economic growth from resource consumption is not possible. Some may be possible. But it takes resources to run an economy. Our data shows how the resource dependence of most countries have increased, even though we have more efficient technology. For instance, we can calculate the average resource intensity in the world – or nations or cities – by sectors. This points out which sectors are within resource intensities that are consistent with the one-planet budget, and which ones are on a collision course.”

Cities are beginning to employ ecological footprinting methods to track the demand on nature of different types of development. To do this other sources of data are added to those on the website.

“We are starting work with six cities in Portugal. We are also in conversation with the Wuppertal Institute, Germany, to run a campaign on all the larger German cities and drive up demand for sustainable solutions,” Wackernagel said.

“They recognise there is a danger of stranded assets due to having exceeded planetary boundaries.

“The framing of the argument is important. The ecological footprint calculator may come over as negative, generating a sense of sacrifice and suffering. We should ask: what is the best move to secure lasting development improvements for us? The alternative – encouraging expansionism – is dangerous.”

Cities can use their own detailed information, he says, to compile a “consumption land use matrix for a city”.

“This details how various consumption activities contribute to the overall demand. Then, using local consumption statistics, this can be extended into the past and future to evaluate trends in the city’s resource performance.”

This has been done already in Calgary, Canada, where consultants worked with a planning department to reduce the level of impact of a new housing development.

The ecological footprint is a useful tool alongside other tools. Although time will tell whether the impact of human consumption on the planet has peaked, it is still at an unsustainable level. It will take much work to actually reverse the rise of the last decades to a sustainable one, especially given the inexorable rise of human population and urbanisation.

For more information on this topic, see: theoneplanetlife.com

David Thorpe is the author of The One Planet Life, about living within planetary boundaries, Passive Solar Architecture Pocket Referenceand Sustainable Home Refurbishment.

Tuesday, April 17, 2018

Is this Tory Government the greenest ever?

British Conservative politicians are spearheading efforts to phase out coal and go net-zero – and that’s just the start of their Green policy-making. What's going on?

Britain’s Energy and Clean Growth Minister, Claire Perry, has called for Parliament to draft new laws that will cut emissions to net-zero.

This follows her trip to New York last week when she attended the Bloomberg Future Energy Summit in New York last week where she set out the case for making coal history. “By phasing out traditional coal power, we are not only taking active steps to tackle climate change, we are also protecting the air we breathe by reducing harmful pollution. The Powering Past Coal Alliance sends a clear signal that the time for unabated coal fired electricity has well and truly passed,” Perry told her New York audience.

The Powering Past Coal Alliance was launched by Perry and her Canadian counterpart Catherine McKenna, the Minister for Climate Change, three days after the COP23 climate change conference last November. Its members number 27 countries plus a host of regions and businesses. Ireland, one of the most recent to join, has pledged to close its one remaining coal plant by 2025 at the latest.

“The UK leads the world in tackling climate change – we have reduced emissions by more than 40 per cent since 1990,” Perry said.

She is not wrong. UK carbon emissions dropped 2.6 per cent in 2017 compared to the previous year, a 43 per cent reduction since 1990. Renewables powered more than coal and nuclear combined during the final quarter. Emissions are now at a level not seen since the end of the 19th century when the industrial revolution was in full swing.

Wales is fast switching away from coal to renewables (it once was the world’s biggest coal exporter) and in Scotland wind power supplied 173 per cent of Scotland’s entire electricity demand on March 1. Even on the worst day for wind during the first quarter of 2018, January 11, wind powered the equivalent of over 575,000 homes there.

Perry said she hopes Australia and more countries, businesses, and regions will soon join New Zealand, France and Italy and sign up to the Powering Past Coal Alliance.

“Australia has different choices to make, and it would be wrong of us to sit here in Britain and prescribe what Australia’s energy policy should be, what we’re trying to do is to help and to show that there is a way through this,” she said.

A statement on the Canadian government’s website states the reason for the Alliance:

Drax Power Station in Yorkshire, Britain’s largest electricity generator, stands as a symbol of this change. It was once dubbed ‘the dirty old man of Europe’ for being the most polluting British power station and a focus of climate change campaigners' actions. The activists have won. No longer does it burn coal; three of its six generators burn wood, albeit controversially imported from the USA.

But although she is against coal and has today said the UK government will ask its climate watchdog to consider how the UK could meet 1.5C Paris target and become net zero, Perry has also said she supports the UK oil and gas industry. In January she told the Maximising Economic Recovery Forum held by the Oil and Gas Authority in Aberdeen: “We want to squeeze every last drop at the right economic price out of the North Sea basin. I think we’ve underestimated what we still have in terms of reserves,” for which she was criticised by Aberdeen’s own MP. Does she speak with a forked tongue? Time will tell.

Former Conservative Party leader David Cameron’s coalition government in 2010 promised to be “the greenest government ever”, although his efforts were undermined by his own Treasury and by political appointments to the Department for Environment, Farming and Rural Affairs (DEFRA).

Yet this shows that conservation is, in Britain at least, naturally a core conservative ideal, even though, the Conservative Party being a broad church, it does contain a number of vociferous climate sceptics, such as former DEFRA Secretary of State Owen Paterson and former Chancellor of the Exchequer Nigel Lawson.

Whilst the environmental credibility of the current Conservative leader Theresa May is debatable, the current DEFRA secretary, Michael Gove, has been praised by Greenpeace, WWF and, albeit cautiously, Green Party leader Caroline Lucas.

Gove has seen an opportunity to rebrand himself as a progressive since his self-inflicted downfall due to a botched bid to lead his party after his team-up with Boris Johnson drove the pro-Brexit bus to victory and kicked out David Cameron from the post. Theresa May, in a surprise move, put him in charge of DEFRA, since when he has hardly seemed to be the same person as the Gove who was once in charge of the Education Department, overseeing a return to ‘traditional teaching values’ and alienating virtually every teacher in the country.

His promises (and most of them are still promises in the form of consultations) include banning ivory sales in an effort to reduce elephant poaching, banning all petrol and diesel cars and vans by 2040 (critics want it sooner), committing to safeguarding coral reefs, introducing a deposit scheme for all drinks containers across England, support for a total ban on insect-harming pesticides across Europe, and making farming subsidies dependent on farmers proving that they are genuinely improving biodiversity and soil quality.

Concern has been loudly heard that, post-Brexit, these protections will be weakened. The British public overwhelmingly backs retaining these food and environmental standards. In response, Gove has promised a consultation on a new, independent body to enforce environmental law, although the future extent of its powers is uncertain.

But Trump’s White House has stressed that any new trade deal it forges with the UK cannot include current EU food standards that block the import of American products such as chlorine-washed chickens, hormone-treated beef, and crops washed with various herbicide chemicals. Further environmental battles over trade deals clearly lie ahead.

This impels the UK economy towards a more sustainable future and is the underlying reason for much of the above. Under it, every five years, the government of the day – of whatever hue – must adopt a legally-binding carbon budget that sets, 15 years ahead, limits on the economy’s total greenhouse gas emissions for the following five year period.

If that sounds ludicrous to some right-wingers, it is what businesses and investors want, because it gives them the time and confidence to plan ahead. It has been extremely successful.

If Australians seek allies in persuading Abbott to change his tune, they really need to look no further than Britain’s Tories and their business supporters.

David Thorpe’s two new books are Passive Solar Architecture Pocket Reference and Solar Energy Pocket Reference. He’s also the author of Energy Management in Building and Sustainable Home Refurbishment.

This is an updated version of an article published on The Fifth Estate on 10 April.

|

| Claire Perry, Energy and Clean Growth Minister |

Britain’s Energy and Clean Growth Minister, Claire Perry, has called for Parliament to draft new laws that will cut emissions to net-zero.

This follows her trip to New York last week when she attended the Bloomberg Future Energy Summit in New York last week where she set out the case for making coal history. “By phasing out traditional coal power, we are not only taking active steps to tackle climate change, we are also protecting the air we breathe by reducing harmful pollution. The Powering Past Coal Alliance sends a clear signal that the time for unabated coal fired electricity has well and truly passed,” Perry told her New York audience.

The Powering Past Coal Alliance was launched by Perry and her Canadian counterpart Catherine McKenna, the Minister for Climate Change, three days after the COP23 climate change conference last November. Its members number 27 countries plus a host of regions and businesses. Ireland, one of the most recent to join, has pledged to close its one remaining coal plant by 2025 at the latest.

|

| Catherine McKenna, Canadian Minister for Climate Change |

“The UK leads the world in tackling climate change – we have reduced emissions by more than 40 per cent since 1990,” Perry said.

She is not wrong. UK carbon emissions dropped 2.6 per cent in 2017 compared to the previous year, a 43 per cent reduction since 1990. Renewables powered more than coal and nuclear combined during the final quarter. Emissions are now at a level not seen since the end of the 19th century when the industrial revolution was in full swing.

Wales is fast switching away from coal to renewables (it once was the world’s biggest coal exporter) and in Scotland wind power supplied 173 per cent of Scotland’s entire electricity demand on March 1. Even on the worst day for wind during the first quarter of 2018, January 11, wind powered the equivalent of over 575,000 homes there.

Perry said she hopes Australia and more countries, businesses, and regions will soon join New Zealand, France and Italy and sign up to the Powering Past Coal Alliance.

“Australia has different choices to make, and it would be wrong of us to sit here in Britain and prescribe what Australia’s energy policy should be, what we’re trying to do is to help and to show that there is a way through this,” she said.

A statement on the Canadian government’s website states the reason for the Alliance:

"Coal is one of the most greenhouse-gas intensive means of generating electricity, and coal-fired power plants still account for almost 40 per cent of the world’s electricity today. This reality makes carbon pollution from coal electricity a leading contributor to climate change.

"As a result, phasing out traditional coal power is one of the most important steps that can be taken to tackle climate change and meet our Paris Agreement commitment to keeping global temperature from increasing by 2 °C and pursuing efforts to limit the increase to 1.5 °C. An analysis shows that, to meet this commitment, a coal phase-out is needed by no later than by 2030, in the Organisation for Economic Co-operation and Development and in the European Union, and by no later than by 2050, in the rest of the world."

|

| Drax power station |

Drax Power Station in Yorkshire, Britain’s largest electricity generator, stands as a symbol of this change. It was once dubbed ‘the dirty old man of Europe’ for being the most polluting British power station and a focus of climate change campaigners' actions. The activists have won. No longer does it burn coal; three of its six generators burn wood, albeit controversially imported from the USA.

But although she is against coal and has today said the UK government will ask its climate watchdog to consider how the UK could meet 1.5C Paris target and become net zero, Perry has also said she supports the UK oil and gas industry. In January she told the Maximising Economic Recovery Forum held by the Oil and Gas Authority in Aberdeen: “We want to squeeze every last drop at the right economic price out of the North Sea basin. I think we’ve underestimated what we still have in terms of reserves,” for which she was criticised by Aberdeen’s own MP. Does she speak with a forked tongue? Time will tell.

It’s not just action on climate change

Thirty years ago the Conservative’s patron saint, Margaret Thatcher, was one of the first politicians to warn the world about climate change. She went on to say that “no generation has a freehold on this Earth. All we have is a life tenancy – with a full repairing lease.”Former Conservative Party leader David Cameron’s coalition government in 2010 promised to be “the greenest government ever”, although his efforts were undermined by his own Treasury and by political appointments to the Department for Environment, Farming and Rural Affairs (DEFRA).

Yet this shows that conservation is, in Britain at least, naturally a core conservative ideal, even though, the Conservative Party being a broad church, it does contain a number of vociferous climate sceptics, such as former DEFRA Secretary of State Owen Paterson and former Chancellor of the Exchequer Nigel Lawson.

Whilst the environmental credibility of the current Conservative leader Theresa May is debatable, the current DEFRA secretary, Michael Gove, has been praised by Greenpeace, WWF and, albeit cautiously, Green Party leader Caroline Lucas.

|

| Michael Gove, Defra Secretary of State |

Gove has seen an opportunity to rebrand himself as a progressive since his self-inflicted downfall due to a botched bid to lead his party after his team-up with Boris Johnson drove the pro-Brexit bus to victory and kicked out David Cameron from the post. Theresa May, in a surprise move, put him in charge of DEFRA, since when he has hardly seemed to be the same person as the Gove who was once in charge of the Education Department, overseeing a return to ‘traditional teaching values’ and alienating virtually every teacher in the country.

His promises (and most of them are still promises in the form of consultations) include banning ivory sales in an effort to reduce elephant poaching, banning all petrol and diesel cars and vans by 2040 (critics want it sooner), committing to safeguarding coral reefs, introducing a deposit scheme for all drinks containers across England, support for a total ban on insect-harming pesticides across Europe, and making farming subsidies dependent on farmers proving that they are genuinely improving biodiversity and soil quality.

The Brexit factor and Trump’s trade issues

Much of the UK’s environmental policy derives from its membership of the EU, which has raised standards arguably well beyond what they would have been otherwise.Concern has been loudly heard that, post-Brexit, these protections will be weakened. The British public overwhelmingly backs retaining these food and environmental standards. In response, Gove has promised a consultation on a new, independent body to enforce environmental law, although the future extent of its powers is uncertain.

But Trump’s White House has stressed that any new trade deal it forges with the UK cannot include current EU food standards that block the import of American products such as chlorine-washed chickens, hormone-treated beef, and crops washed with various herbicide chemicals. Further environmental battles over trade deals clearly lie ahead.

The Climate Change Act

It remains a small miracle that the 2008 Climate Change Act, a product of the Labour government, has not been repealed by the Tories. It is a phenomenal piece of legislation that enshrines in law a long-term goal of reducing greenhouse gas emissions by 80 per cent by 2050 relative to 1990 levels.This impels the UK economy towards a more sustainable future and is the underlying reason for much of the above. Under it, every five years, the government of the day – of whatever hue – must adopt a legally-binding carbon budget that sets, 15 years ahead, limits on the economy’s total greenhouse gas emissions for the following five year period.

If that sounds ludicrous to some right-wingers, it is what businesses and investors want, because it gives them the time and confidence to plan ahead. It has been extremely successful.

If Australians seek allies in persuading Abbott to change his tune, they really need to look no further than Britain’s Tories and their business supporters.

David Thorpe’s two new books are Passive Solar Architecture Pocket Reference and Solar Energy Pocket Reference. He’s also the author of Energy Management in Building and Sustainable Home Refurbishment.

Thursday, April 12, 2018

Troubling questions over Macquarie’s purchase of the Green Investment Bank

When Macquarie Bank bought the UK’s Green Investment Bank it ignited a storm of opposition. There was doubt the Aussie bankers would uphold the original ambitions of the GIB, because these ambitions are not sufficiently protected. That’s now the conclusion of an investigation by British MPs on the UK House of Commons Public Accounts Committee.

Furthermore, the MPs have not picked up the fact that it is no longer under full government control how the £200m foreign aid is spent that is supposed to support clean energy and climate change mitigation projects in developing countries under Britain's international agreement obligations.

Labelled a “Vampire Kangaroo” in 2013 by the Sunday Times, a view supported by a BBC investigation into Macquarie’s ownership of Thames Water, the sale was widely condemned at the time.

The committee of MPs, supported by the National Audit Office, was charged at looking at whether the controversial sell-off was conducted properly and whether the GIB performed well in the past and would fulfil its intended function to invest in promising new sustainable technologies in the future.

Since it was created in 2012, the UK Green Investment Bank plc (GIB) has been successful in attracting private investment into some sectors of the green economy, such as offshore wind projects, according to its former chief executive Shaun Kingsbury.

However, Alex Chisholm, Permanent Secretary for the Department for Business, Energy & Industrial Strategy (BEIS), the government department which set it up, told the MPS it cannot be sure whether the GIB achieved its intended objectives of “encouraging investment in the green economy and creating an institution that lasts”.

This is because the government chose to sell the bank before fully assessing its impact. The decision was based purely on a desire to reduce public debt and secure cash for the public purse from the sale.

Macquarie bought the bank for £1.6 billion in August 2017 in a deal hailed in The Australian Financial Review as “a potential game changer for Macquarie globally because the assets, skills and connections it brings to the group will give it an edge in two of the biggest investment megatrends over the next several decades – renewable energy and impact investing”

Certain measures were attached to the sale intended to protect the bank’s original Green Purposes, which cover greenhouse gas emissions, efficient use of natural resources, the natural environment, biodiversity and environmental sustainability. However the MPs found that these are not sufficient to ensure that the bank is an enduring institution.

“It is unclear whether Green Investment Group (GIG, as it has been rebranded under Macquarie’s ownership) will continue to support the government’s energy policy, or continue to have an impact on the UK’s climate change goals,” the MPs say, declaring it as “a misjudgement” that the Department has so little assurance over GIG’s future investment in the UK and in emerging technologies, which are crucial to ensuring that the UK’s green commitments are met.

Sir Geoffrey Clifton-Brown MP, the Committee’s Deputy Chair, called the manner of the sale “deeply regrettable”. “The rebranded Green Investment Group is not bound to invest in the UK’s energy policy at all, nor to invest in the kind of technologies that support its climate objectives,” he said.

“Had the government been shrewder it could have secured a better return for taxpayers. It was a mistake to repeal legislation protecting GIB’s green investment obligations without securing firmer commitments from potential buyers.”

Ironically Macquarie actually told the MPs that such commitments did not affect the price it was prepared to pay, and indicated that the government could and should have strengthened these commitments contractually.

These projects were primarily in offshore wind, and waste and bioenergy, with some in energy efficiency and onshore renewables.

Many other technologies, such as tidal power and carbon capture and storage, were judged by the bank’s board to be not sufficiently developed to be suitable commercial investments. But because the BEIS did not give clear criteria, it could not judge whether GIB was addressing failures in the green energy market or only backing projects that would have been winners anyway.

But this protection relies on Macquarie continuing to fund the Green Purposes Company and the powers of the trustees do not extend to approval of investment decisions.

Macquarie has committed GIG to investing or arranging over £3 billion investment in green energy projects over three years after purchase but these commitments are not legally binding and rely on a number of factors, including market conditions and future government policy decisions.

Mark Dooley, global head of green energy, Macquarie, told the MPs that GIG is not currently required or incentivised to invest in the UK, or innovative technologies, or to focus on any of GIB’s five Green Purposes.

MacBank wants government support to stick to the plan

According to Macquarie, for the majority of potential investments in the UK it would want financial support from the government. These include the proposed world-leading tidal lagoon in Swansea, which, lacking government support based on a high strike price and an environmental impact report, seems unlikely to go ahead.

Since it became the Green Investment Group, it has continued to invest in safe sectors – wind and waste-to energy projects – rather than emerging technologies.

David Fass, head of Macquarie Group’s European operations says Macquarie will use the GIG to channel “billions in renewable energy deals over the next decade”… “unless Macquarie doesn’t meet the expectations of a range of stakeholders”.

“This piece of intellectual property could well be sold or brought to market in partnership with financial information companies, Standard & Poor’s or Moody’s Investors Service. A product that secures investor trust in green investments could be extremely valuable,” it says.

For over two years no investment was made, but in autumn last year Macquarie announced £12.4m of the £200m had been pledged to Lightsource to develop and construct up to a total of 300MW of PV projects in rural India.

It’s still unclear who banks (and obtains interest from) the remaining cash.

The UK National Audit Office (who conducted some of the research for the MPs’ report) told me last September following a Freedom of Information request that their remit for this research (and therefore the MPs’ report) did not cover the UKCI. They did say that $22.65m of the total amount had already been spent – on consultants to do market surveys, of no direct benefit to developing countries.

It’s unclear how much say the UK government now has in how this money is spent, but surely it should be spent to the benefit of the poor in developing countries trying to fight climate change rather than the shareholders of a private investment company?

These countries are sick of waiting for the money to come to them.

Sir Geoffrey Clifton-Brown concludes his comment on the House of Commons report on the GIB by saying: “There are broader lessons here—not least for how government evaluates public assets and, when relevant, prepares them for sale.”

And the net benefit to the British taxpayer of all of the sale? Just £126 million.

David Thorpe is a UK based writer. His two new books are Passive Solar Architecture Pocket Reference and Solar Energy Pocket Reference. He’s also the author of Energy Management in Building and Sustainable Home Refurbishment.

Furthermore, the MPs have not picked up the fact that it is no longer under full government control how the £200m foreign aid is spent that is supposed to support clean energy and climate change mitigation projects in developing countries under Britain's international agreement obligations.

A version of this post was first published on 3 April on The Fifth Estate.

Labelled a “Vampire Kangaroo” in 2013 by the Sunday Times, a view supported by a BBC investigation into Macquarie’s ownership of Thames Water, the sale was widely condemned at the time.

The committee of MPs, supported by the National Audit Office, was charged at looking at whether the controversial sell-off was conducted properly and whether the GIB performed well in the past and would fulfil its intended function to invest in promising new sustainable technologies in the future.

Since it was created in 2012, the UK Green Investment Bank plc (GIB) has been successful in attracting private investment into some sectors of the green economy, such as offshore wind projects, according to its former chief executive Shaun Kingsbury.

However, Alex Chisholm, Permanent Secretary for the Department for Business, Energy & Industrial Strategy (BEIS), the government department which set it up, told the MPS it cannot be sure whether the GIB achieved its intended objectives of “encouraging investment in the green economy and creating an institution that lasts”.

This is because the government chose to sell the bank before fully assessing its impact. The decision was based purely on a desire to reduce public debt and secure cash for the public purse from the sale.

Macquarie bought the bank for £1.6 billion in August 2017 in a deal hailed in The Australian Financial Review as “a potential game changer for Macquarie globally because the assets, skills and connections it brings to the group will give it an edge in two of the biggest investment megatrends over the next several decades – renewable energy and impact investing”

Certain measures were attached to the sale intended to protect the bank’s original Green Purposes, which cover greenhouse gas emissions, efficient use of natural resources, the natural environment, biodiversity and environmental sustainability. However the MPs found that these are not sufficient to ensure that the bank is an enduring institution.

“It is unclear whether Green Investment Group (GIG, as it has been rebranded under Macquarie’s ownership) will continue to support the government’s energy policy, or continue to have an impact on the UK’s climate change goals,” the MPs say, declaring it as “a misjudgement” that the Department has so little assurance over GIG’s future investment in the UK and in emerging technologies, which are crucial to ensuring that the UK’s green commitments are met.

Sir Geoffrey Clifton-Brown MP, the Committee’s Deputy Chair, called the manner of the sale “deeply regrettable”. “The rebranded Green Investment Group is not bound to invest in the UK’s energy policy at all, nor to invest in the kind of technologies that support its climate objectives,” he said.

“Had the government been shrewder it could have secured a better return for taxpayers. It was a mistake to repeal legislation protecting GIB’s green investment obligations without securing firmer commitments from potential buyers.”

Ironically Macquarie actually told the MPs that such commitments did not affect the price it was prepared to pay, and indicated that the government could and should have strengthened these commitments contractually.

How successful was the Green Investment Bank?

The GIB attracted substantial private investment into some sectors of the green economy, such as offshore wind. By March 2017, GIB had committed $6.21 billion to fund or part fund 100 projects, and attracted $15.71 billion of private capital.These projects were primarily in offshore wind, and waste and bioenergy, with some in energy efficiency and onshore renewables.

Many other technologies, such as tidal power and carbon capture and storage, were judged by the bank’s board to be not sufficiently developed to be suitable commercial investments. But because the BEIS did not give clear criteria, it could not judge whether GIB was addressing failures in the green energy market or only backing projects that would have been winners anyway.

| GIB investment activity between October 2012 and March 2017, by sector | |||||

| Sector | Offshore wind | Waste & bioenergy | Energy efficiency | Onshore renewables | Total |

| Number of projects | 11 | 37 | 35 | 17 | 100 |

| GIB capital committed (£ millions) | 2,211 | 756 | 292 | 150 | 3,409 |

| Private capital mobilised (£ millions) | 4,660 | 3,479 | 286 | 150 | 8,575 |

| Average total transaction size (£ millions) | 625 | 114 | 17 | 18 | 120 |

Will Macquarie continue its mission?

When it acquired GIB, Macquarie agreed to retain its five Green Purposes, the protection of which was the aim of the Green Purposes Company, which BEIS had established previously and given its trustees powers to veto any changes.But this protection relies on Macquarie continuing to fund the Green Purposes Company and the powers of the trustees do not extend to approval of investment decisions.

Macquarie has committed GIG to investing or arranging over £3 billion investment in green energy projects over three years after purchase but these commitments are not legally binding and rely on a number of factors, including market conditions and future government policy decisions.

Mark Dooley, global head of green energy, Macquarie, told the MPs that GIG is not currently required or incentivised to invest in the UK, or innovative technologies, or to focus on any of GIB’s five Green Purposes.

MacBank wants government support to stick to the plan

According to Macquarie, for the majority of potential investments in the UK it would want financial support from the government. These include the proposed world-leading tidal lagoon in Swansea, which, lacking government support based on a high strike price and an environmental impact report, seems unlikely to go ahead.

Since it became the Green Investment Group, it has continued to invest in safe sectors – wind and waste-to energy projects – rather than emerging technologies.

David Fass, head of Macquarie Group’s European operations says Macquarie will use the GIG to channel “billions in renewable energy deals over the next decade”… “unless Macquarie doesn’t meet the expectations of a range of stakeholders”.

A valuable asset in green investment definition